Spotify rode a post-election wave of market enthusiasm to close above $400 for the first time on Friday (Nov. 8), valuing the music-streaming giant at nearly $80.5 billion. Before finishing at $400.68, up 4.1% for the week, the company’s stock reached an all-time high of $405.88.

The Stockholm, Sweden-based company’s stock price has increased 113% in 2024 as the company overtook Universal Music Group (UMG) as the most valuable music company. When investors began to tire of high-growth streaming companies with little to show in profitability, Spotify underwent two major rounds of layoffs in 2023, helping reduce costs without sacrificing subscriber growth or revenue. With third-quarter earnings coming on Tuesday (Nov. 12), Spotify will show whether it has maintained that momentum. At least one analyst is optimistic ahead of earnings: Deutsche Bank raised its Spotify price target on Wednesday to $440 from $430.

U.S. stock markets soared this week following the election of Donald Trump on Tuesday (Nov. 5) and the U.S. Federal Reserve’s decision on Thursday (Nov. 7) to lower interest rates by a quarter of a percentage point. On Friday, the Nasdaq composite closed at an all-time high of 19,286.78, up 5.7%. The S&P 500 gained 4.7% to close at a record high of 5,995.54. China’s Shanghai Composite Index rose 5.5% to 3,452.30. South Korea’s KOSPI composite index improved just 0.7% to 2,561.15. In the U.K., the FTSE 100 fell 1.3% to 8,072.39.

Trending on Billboard

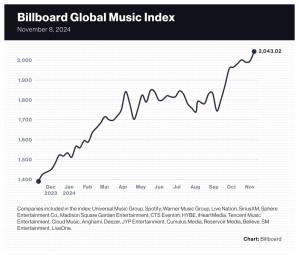

The 20-company Billboard Global Music Index gained 2.4% to an all-time high of 2,043.02, bringing its year-to-date gain to 33.2%. The index had 13 stocks in positive territory while six lost ground and one was unchanged.

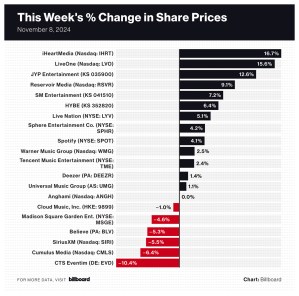

The week’s top music stock was iHeartMedia, which jumped 16.7% to $2.44 after the company announced it will restructure much of its retiring debt and plans to save $200 million in 2025 through cost cuts and the embrace of technology. “Technology is the key to increasing our operating leverage and is a constant focus for us,” CEO Bob Pittman said during an earnings call on Thursday. “It allows us to speed up processes, streamline legacy systems and it enables our folks to create more, better and faster.” iHeartMedia shares are down 8.6% year to date but have risen 180% since May 24.

LiveOne gained 15.6% to $0.89 per share after the music streamer announced that revenue increased 14% to $32.6 million and paid members rose 27% to 645,000 in its fiscal second quarter ended Sept. 30. Reservoir Media was another top gainer, improving 9.1% to $9.00.

On the live front, Live Nation shares rose 5.1% to $123.02 following a post-election day boost. The concert promoter is currently facing a lawsuit from the U.S. Department of Justice but could find a better outcome from new appointments made by the Trump administration. The election wasn’t the only reason for the stock’s gains: Morgan Stanley upped its price target to $140 from $120 based on “a combination of strong underlying consumer demand and powerful artist incentives to tour,” analysts wrote in an investor note on Tuesday. Deutsche Bank also increased its Live Nation price target to $130 from $122.

K-pop stocks surged this week despite HYBE and SM Entertainment both reporting sharp drops in profit last quarter due partly to weaker recorded music revenues. HYBE shares jumped 6.4% after the company reported a 99% drop in net income. Likewise, SM Entertainment gained 7.2% the same week the company announced quarterly net profit fell 96% on a 9% revenue decline and a 36% drop in recorded music revenue. Investors may have gained optimism from SM Entertainment’s announcement it will launch a new girl group — its first since aespa debuted five years ago — in 2025 with a single and album release in the first quarter.

JYP Entertainment, which has not yet announced quarterly earnings, shot up 12.6%, and YG Entertainment continued its hot streak, rising 6.3% and bringing its gain in the last three weeks to 17.6%. YG has received a boost from the success of “APT” by ROSÉ featuring Bruno Mars. The song is currently in its second week atop both the Billboard Global 200 and Billboard Global Excl. U.S. charts.

Tencent Music Entertainment (TME) shares rose 2.4% to $11.39 ahead of the company’s third-quarter earnings on Tuesday (Nov. 12). Bernstein initiated coverage of TME with a $14 price target. Barclays initiated coverage with an “overweight” rating and a $16 price target.

German concert promoter CTS Eventim was the worst-performing music stock of the week, dropping 10.4% to 87.70 euros ($94.05). The company will release third-quarter results on Nov. 21. Elsewhere, Cumulus Media dropped 6.4% to $0.88, adding to the prior week’s 19% decline, while SiriusXM dropped 5.5% to $26.13.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper